Filing taxes as a new business owner is a little different than filing when working for another company. Thankfully, our accountants at JLW Tax & Bookkeeping Services in Springfield, IL are here to help you every step of the way. It’s important to stay informed on the types of information and forms you will need to complete your upcoming taxes, so keep reading to see which taxes you will need depending on the type of business you are in! Don’t forget to reach out to our accountants before tax season begins to avoid strict federal deadlines.

Sole Proprietorship & LLC Businesses

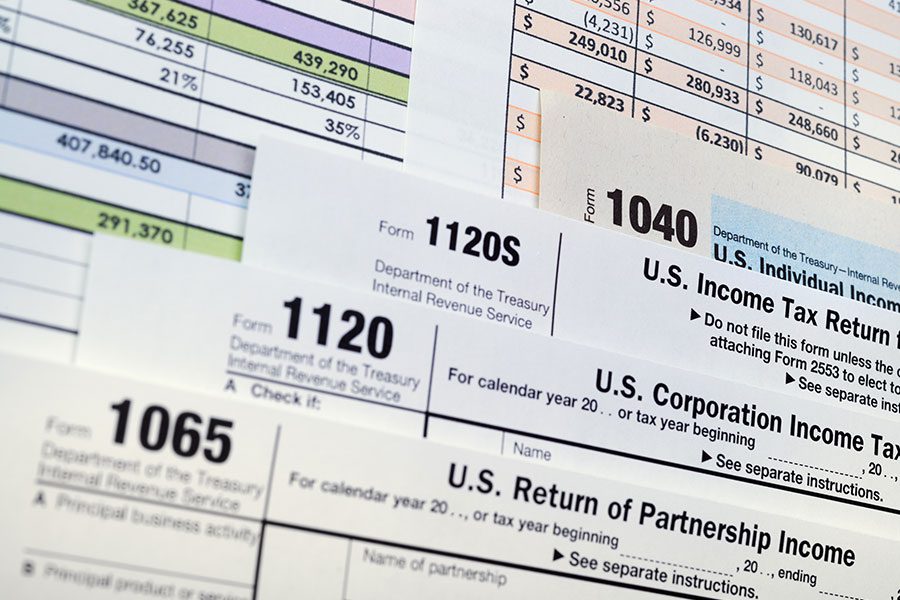

A sole proprietorship or LLC business is one of the most common ways of filing taxes as a small business owner. Similar to filing as an individual working for a separate company, you will need your standard, personal 1040 tax return. This process is just as simple with your JLW Tax & Bookkeeping Services accountant – simply fill our Schedule C on your 1040 tax return with information about your business’s profits and losses. Depending on the amount of profit you claim will determine how much you owe or are refunded once your return is submitted.

Partnership Businesses

If you own a small business with someone else, then filing as a partnership is a great way to complete your yearly taxes. Similar to filing as an LLC, a partnership tax return can be completed by filling out a standard 1040 tax return under the Schedule SE. This will show how much money your partnership business profited in the last year and how much losses were accounted for. After completing the 1040 form, you and your partner will need to fill out a separate 1065 form detailing the partnership profits and losses that also need to be accounted for. If you are unsure of which profits and losses need to be separated, contact our accountants at JLW Tax & Bookkeeping Services in Springfield, IL. We help local businesses file their taxes in a stress-free environment!

If you own a small business with someone else, then filing as a partnership is a great way to complete your yearly taxes. Similar to filing as an LLC, a partnership tax return can be completed by filling out a standard 1040 tax return under the Schedule SE. This will show how much money your partnership business profited in the last year and how much losses were accounted for. After completing the 1040 form, you and your partner will need to fill out a separate 1065 form detailing the partnership profits and losses that also need to be accounted for. If you are unsure of which profits and losses need to be separated, contact our accountants at JLW Tax & Bookkeeping Services in Springfield, IL. We help local businesses file their taxes in a stress-free environment!

S Corporation Businesses

Filing your business under an S corporation status has a variety of benefits. Not only are you not subject to double taxation like a C corporation, but you can have multiple investment opportunities and only are required to file for taxes once a year like standard LLC businesses. When filing your taxes,JLW Tax & Bookkeeping Services is here to provide the forms you need to complete your tax return. You will need to file an 1120 S form to report your business’s profits and losses – thankfully our accountants in Springfield, IL are trained and qualified to help!

C Corporation Businesses

A C corporation varies from an S corporation simply in the way these businesses file taxes. C corporation businesses have two different forms that are needed to complete their tax return, an 1120-A and an 1120-W. These forms report the profits and losses of your C corporation business, while also requiring double taxation on your company’s revenue, as well as your shareholder’s income. If you already own a C corporation business or are just starting one, JLW Tax & Bookkeeping Services is here to help you in Springfield, IL. Schedule a free consultation today at 217.679.1872 and speak with one of our experienced accountants.