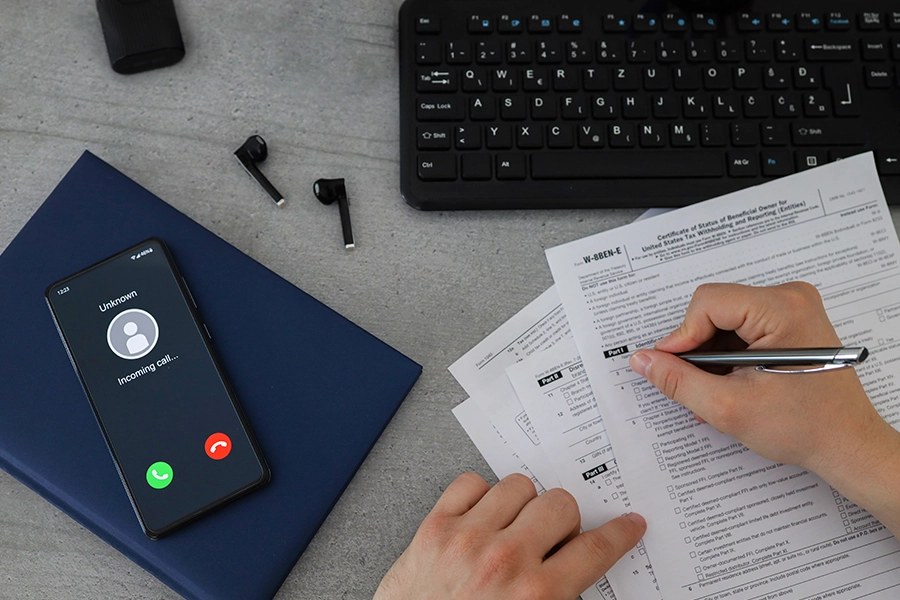

Tax scams can appear in all different forms. Some common scams are through text messages, fraudulent emails, and false tax returns. One of the most common scams is fake IRS agents calling you and threatening you to pay them cash or you will get arrested. Phishing scams are another common scam residents of Springfield, IL will face. These phishing scams consist of fake emails claiming to be from the IRS and trying to get your social security number and other personal information. If you have ever had your identity stolen, scammers will use your social security number to file a tax return in your name and avoid paying the back taxes but will keep your refund.

Identifying Tax Scams

When you get hit with common tax scams, it can be not easy to decipher whether it is the real IRS trying to contact you or a scammer faking it. If you receive a suspicious phone call from the IRS, it’s important to know that the real IRS will never threaten you with being arrested if you don’t give them cash immediately. If you receive a phishing email, you should note that the IRS will never email taxpayers requesting personal information. If you receive a 1099 for unemployment that you never claimed, it’s a sign that someone has stolen your identity and filed under your name. When you contact JLW Tax & Bookkeeping Services, our tax preparers can help you identify potential scammers.

Reporting Tax Scams

You might wonder what your next step is once a scammer contacts you. No matter what you do, you should never give your personal information to these scammers. Even if they have the last four digits of your social security number or know some of your personal information, you should hang up or report the fake email. When you receive a fake phone call, write down their number and report it to the Treasury Inspector General for Tax Administration. You should also report scam emails to the same place. If someone has filed taxes under your name, the first thing you will want to do is file a police report and file form 14039 with the IRS for Identity theft. As well as keep an eye on your credit.

Avoiding Tax Scams

There are a few ways you can avoid tax scams. The first thing you can do is file your taxes early. Filing early will lessen the chance of hackers being able to file under your name. If you receive an email asking you to click a link to see your tax return or other specious emails with links, avoid clicking them. Avoid taking any suspicious phone calls claiming to be from the IRS. The IRS will send you a letter in the mail before they ever call you requesting money. For more information on avoiding tax scams, contact JLW Tax & Bookkeeping Services by calling 217.679.1872.