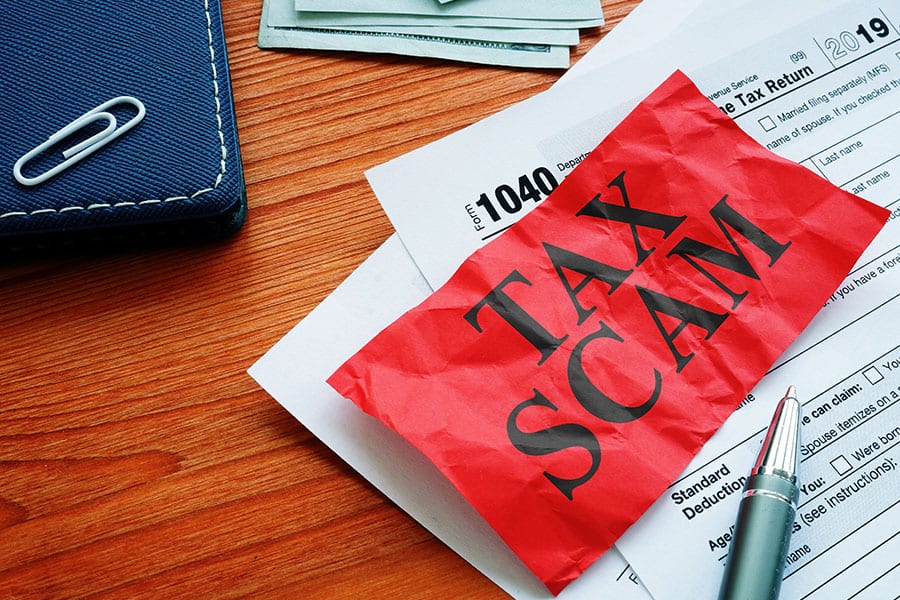

Avoiding Tax Scams & How to Recognize These Threats

Tax scams can appear in all different forms. Some common scams are through text messages, fraudulent emails, and false tax returns. One of the most

Tax scams can appear in all different forms. Some common scams are through text messages, fraudulent emails, and false tax returns. One of the most

Tax scams are a serious issue throughout the United States, and they are constantly being identified and stopped by the IRS every year. However, recognizing

Tax season can undoubtedly be stressful and a bit expensive for some individuals. Unfortunately, these emotions are what attract ghost tax preparers that perform illegal

As a tax professional, you may not think that identity thieves and scammers would try to steal sensitive information from you or your clients, however

For small businesses, maintaining accurate financial records is not just a

Tax season is an opportunity to reclaim some of your hard-earned

At JLW Tax & Bookkeeping Service, we understand that managing your

Managing a small business is a rewarding endeavor, but it comes

Running a successful small business in 2025 requires thoughtful planning, especially

As the new tax season draws near, Illinois taxpayers and tax

For small businesses, maintaining accurate financial records is not just a good practice—it is essential for long-term success. Bookkeeping plays

Tax season is an opportunity to reclaim some of your hard-earned money, but many taxpayers leave valuable deductions and credits

At JLW Tax & Bookkeeping Service, we understand that managing your finances can feel like a daunting task, whether you’re

Managing a small business is a rewarding endeavor, but it comes with its fair share of responsibilities—tax filing being one

Right Click Digital © 2025 • All Rights Reserved. • Privacy Policy