Retail sales tax provides a straightforward method for collecting tax revenue. Unlike the income tax system, which can be intricate and confusing, sales taxes are easy for consumers to grasp because they can see the amount directly on their receipts. In thirty-eight states, excluding Alaska, Delaware, Montana, New Hampshire, and Oregon, consumers face both state and local sales taxes. Even if a state has a moderate statewide sales tax rate, the combined state and local rates can be high compared to other states. At JLW Tax & Bookkeeping Services, we’ve highlighted information on state vs. sales taxes, competition, and strategies to help you navigate the landscape of state and local sales taxes, not just in Springfield, IL, but in other areas as well.

State Taxes

In the complex tapestry of the United States, individual states autonomously establish and regularly apply their taxes within their borders. These state taxes, essential to government revenue, are levied on a spectrum ranging from goods to occasional services. This diversity in tax rates and regulations shapes a multifaceted landscape, especially impactful for businesses operating in sectors like marketing. The intricacies of state taxes exercise significant influence over pricing strategies and financial planning for companies. Businesses need to comprehend and meticulously follow these tax structures. Staying alert to tax law changes is not just good practice; it’s necessary to ensure companies continually comply with the ever-changing state taxation regulations.

Local Taxes

Local taxes, different from state and federal taxes, are imposed by municipalities and counties to fund local services and infrastructure projects. These taxes include property taxes, sales taxes, and sometimes income taxes. Property taxes are based on the value of real estate and significantly contribute to local funds. Sales taxes are applied when buying goods and services, adding to local revenue. Income taxes, if applied, are a direct contribution from residents. These taxes are crucial for supporting community resources like schools, public safety, and infrastructure development. Individuals and businesses in a specific locality need to understand and navigate these local tax structures.

The Competition in Setting Sales Tax Rates

People often avoid sales tax in areas where there’s a significant difference in tax rates between jurisdictions. Research shows that consumers may travel from high-tax areas to low-tax areas, like cities to suburbs, to make major purchases. For instance, in the Chicago area, consumers may buy in surrounding suburbs or online to evade the city’s 10.25 percent sales tax. At the statewide level, businesses may set up just outside high sales-tax areas to avoid those rates. This trend warns state and local governments against raising rates too high relative to their neighbors, as it can result in lower-than-expected revenue or even losses despite higher tax rates.

Strategies for Strategic Pricing

In the highly competitive business landscape, strategic pricing emerges as a powerful tool. A profound comprehension of state and local sales tax rates becomes crucial, allowing businesses to integrate these distinctions into their pricing strategies seamlessly. By doing so, not only does the business uphold transparency for its customers, but it also strategically positions itself to thrive in diverse markets. Recognizing and adapting to the variations in tax structures across regions is not just a financial necessity but a strategic imperative. As businesses navigate these complexities, they not only enhance customer trust through transparency but also gain a competitive edge by aligning their pricing models with the dynamic demands of different markets.

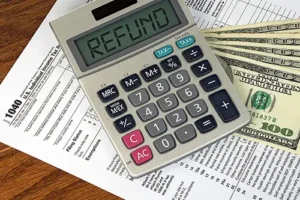

Receive Tax Preparation Services from JLW Tax & Bookkeeping Services

Mastering the nuances of state and local sales tax rates is an ongoing endeavor that requires businesses to remain well-informed. A comprehensive understanding of these intricacies is pivotal in formulating effective strategies aligned with compliance requirements. By skillfully navigating the intricate landscape of state and local sales tax rates, businesses can not only guarantee adherence to regulations but also gain a competitive advantage in today’s diverse and dynamic marketplace. Recognizing the challenges that businesses face in managing both tax intricacies and day-to-day operations, JLW Tax & Bookkeeping Services empathizes with the complexities. That’s why we extend our Bookkeeping services to assist you in maintaining financial stability. For further information about our services, feel free to contact us at 217.679.1872.